Why I Gave Up On Real Estate Investing

(for now)

If you spend more than 10 minutes on social media, there’s no doubt that you will come across someone creating passive income and building massive wealth through real estate. They are flipping/wholesale properties, or Airbnb hacking and only starting with 1 thousand dollars.

Guys are cruising around in Rolls Royce’s, preaching the ease and simplicity of building infinite streams of RE income, and using the banks money to do it all!

First off, these things are almost all bullshit, and you shouldn’t trust them. But the purpose of this article isn’t to discuss the frauds and over-exaggerators of the ease of real-estate.

It’s to talk about the best ways of making piles of cash (that work for you). And hey, real estate might even be it after all.

An Introduction to Leverage (And Why It Matters)

Are you ready to take a massive leap in your mindsets as an entrepreneur/investor?

Then you must start understanding and obsessing over leverage.

Leverage is the key to getting rich, doing things on a big scale. Essentially, it’s about multiplying your efforts. There are three forms of leverage in today’s world.

Capital (investment of other people’s money)

Labor (people working for you)

Tech (code you wrote, or media available online)

These are the three levers you need to pull if you’re ever going to make a pile of cash and ‘succeed’ financially in the business world. Let’s look at an example to illustrate each point.

Let’s say you are insanely talented at cutting grass, and landscaping. You are a veritable picasso with some hedge clippers and a lawn mower.

If you are just going around your neighborhood and doing people’s lawns, there is a very fixed amount you can make. You can only do so many lawns in a day, thus you have no real leverage (despite your amazing skillset).

So, if this was your ‘thing’, how are you going to get rich? Let’s look at each of the levers of leverage to see what you could do.

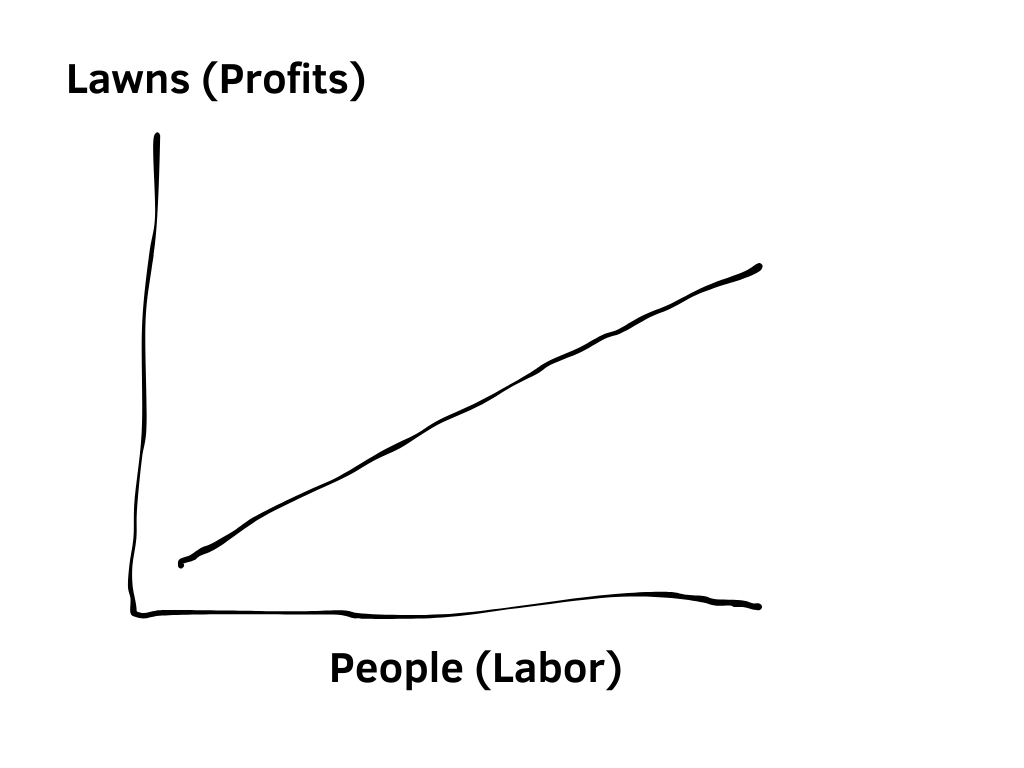

Labor

This is the most obvious one, you could simply start hiring a bunch of employees, and teaching them how to cut grass like a master. More employees means more lawns, and more profits. But, you are still a little limited in the sense that it takes a TON of time to find, hire, train and manage massive amounts of people.

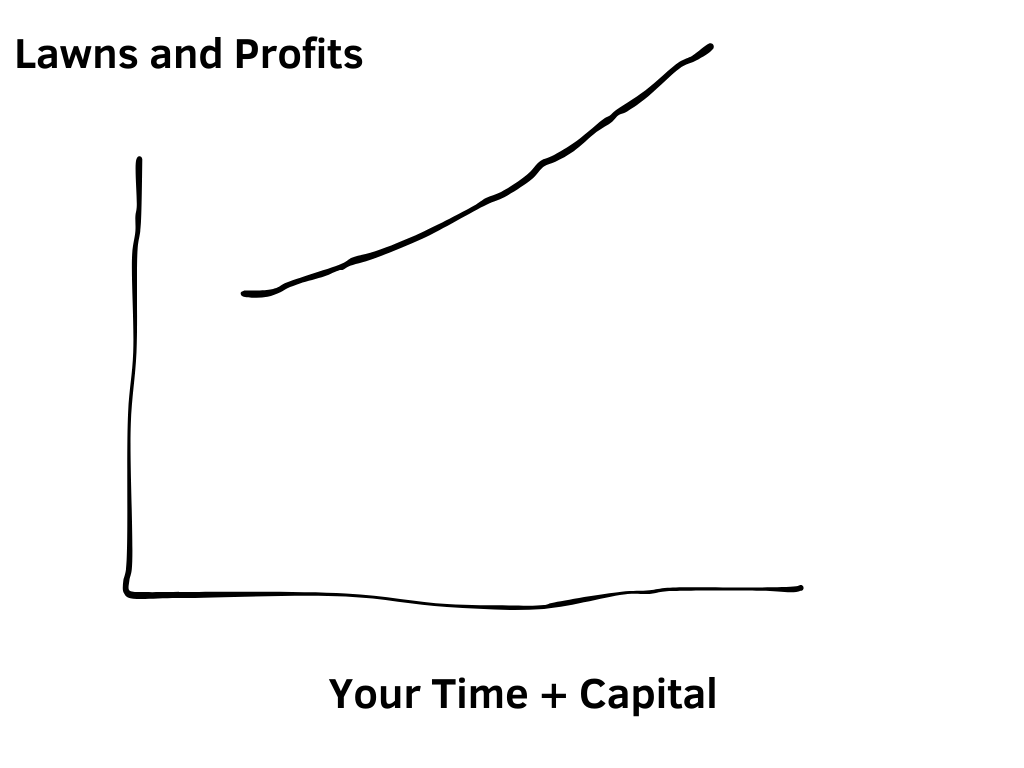

Capital

If you knew a ton about landscaping, i’m sure you could also easily identify other great companies and people that are on your level when it comes to doing lawns. So, if you had the money you could probably pretty easily invest in and ‘pick winners’ in other landscaping companies.

This is a pretty awesome way to do things if you can raise money and convince investors to believe in you. All you’re doing day to day is looking for companies that handle all the other tasks (finding people, hiring people, managing customers etc.) and deciding who to buy and invest in. So your time spent daily, now can get spread out across many companies, not just yours.

Notice this chart starts off way higher, sooner. (You are much more profitable from the start because you are starting with a pile of cash to invest).

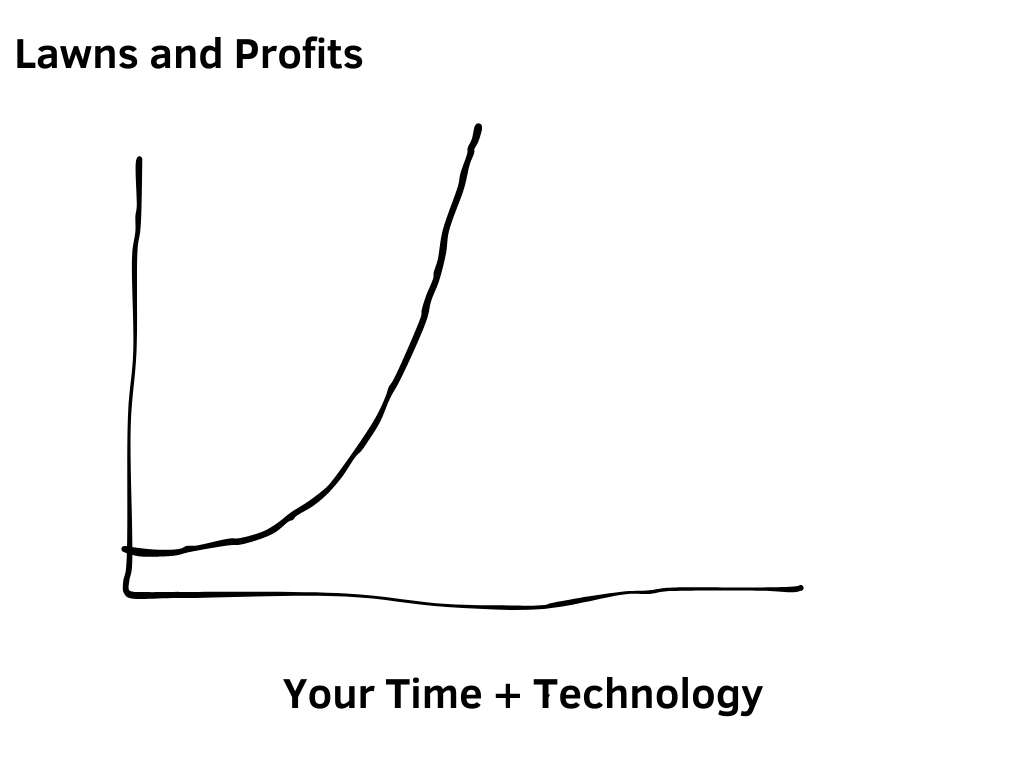

Tech

OK, so investing in lawncare companies is looking pretty great, but there are limits to how many companies you can find, source and invest in. Some will fail, some will underperform, and of course there aren’t enough hours in the day for you to review and vette every single company in existence (in the world), so you are still limited by your time here.

Enter the final lever of leverage, technology.

What if instead of investing in the companies, you were able to build something that ALL landscaping companies could use to improve their business? This could be something like a training course (expert secrets you’ve learned) that owners could use to train their teams more easily and efficiently.

Or maybe it’s a tool. A web platform for a landscaping owner to manage all of their customers, employees, jobs, payments, marketing etc.

Both of these things are infinite when it comes to scale thanks to software and the internet. In theory, every company in the world that did landscaping could buy your course, or use your tool once it’s available online. Whether it’s 1 company or 1,000,000, it would essentially cost you the same time to create and maintain the product. Now THAT is interesting… isn’t it? Let’s look at the chart here.

Technology is the clear winner here. It takes off in an exponential way far sooner and faster than labor, or capital.

Another Look at Real Estate

Knowing what we know now about real estate, which levers does it primarily engage?

Labor, and Capital over time. You need people to find and manage your deals, and you need capital to be able to buy them. These are great levers, and no doubt you can make a ton of money in this game (as many others have before you)

Now which levers are the guys shilling their airbnb arbitrage course pulling? Yup, technology/info. That’s why they’re making a pile selling you a dream, and you’re toiling in the streets trying to get something going.

… but it’s not the best way to do it. Especially if you have any skills in the technology world.

For me, I’m a trained software engineer, with over a decade of building, launching and selling software related products and information products on the internet. I have the capacity to make full use of the 3rd and most juicy lever of leverage (technology). Unfortunately, real estate investing as an individual in multi-family properties doesn’t make the most of this lever.

That’s why I’ve put all thought and efforts in the RE world on hold for now.

That’s not to say it still might be the best path for you… if you have no skills on the internet, or desire to build and sell software… then labor and capital are the best options for you without doubt. Carry on, but with the proper expectations this time.

Just keep an eye on them, to make sure you maximizing (especially capital) in order to grow faster and faster. Don’t just work sunset to sundown cutting lawns yourself. Figure out how to convince investors of your prowess and knowledge, and then reap the fruits of using their cash to multiply your business.

Don’t forget to learn how to cut grass yourself

It’s really easy to get sucked into thoughts of grandeur now that you are thinking in terms of leverage that you forget to actually build the skills. You need to know how to do the basics of the thing first, before you apply leverage.

If you can’t find, evaluate, buy, and manage a single apartment building profitably by yourself… then you have no business raising money to go out and buy 50 of them.

So, starting small, and un-levered is not only fine, but ideal. Master your craft and the fundamentals first.

Then apply as much leverage as you can get your hands on.